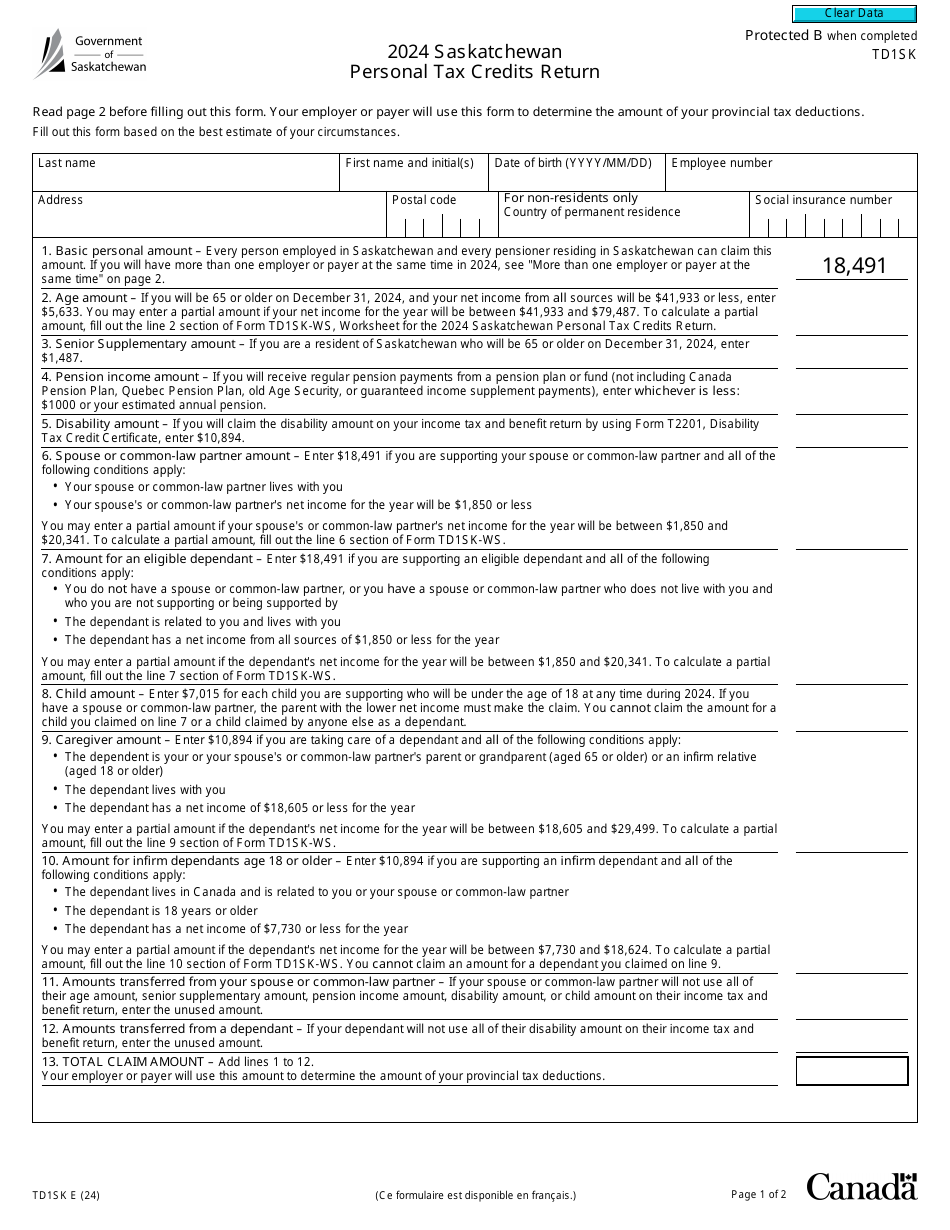

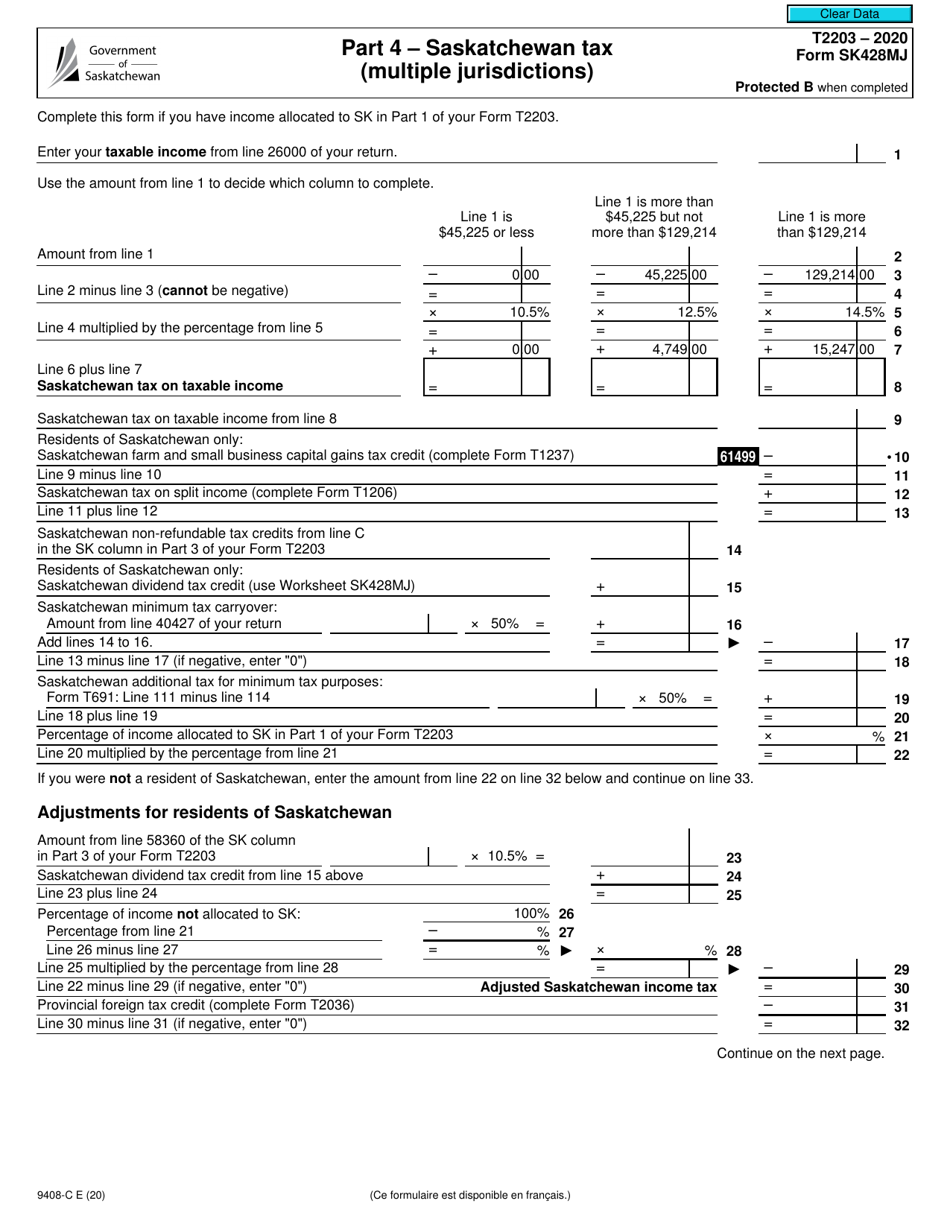

Tax Forms 2025 Saskatchewan Form. The tax tables below include the tax rates, thresholds and allowances included in the saskatchewan tax calculator 2025. The calculator reflects known rates as of june 1, 2025.

Estimate your 2025 tax refund or taxes owed, and check provincial tax rates in saskatchewan. The t5007 income tax form is a statement issued by the saskatchewan workers’ compensation board (wcb) that reports total compensation benefits paid to you, or on your behalf, during a calendar year.

2025 Tax Forms Saskatchewan Dayle Daniela, This includes calculations for employees in saskatchewan to calculate their annual salary after tax.

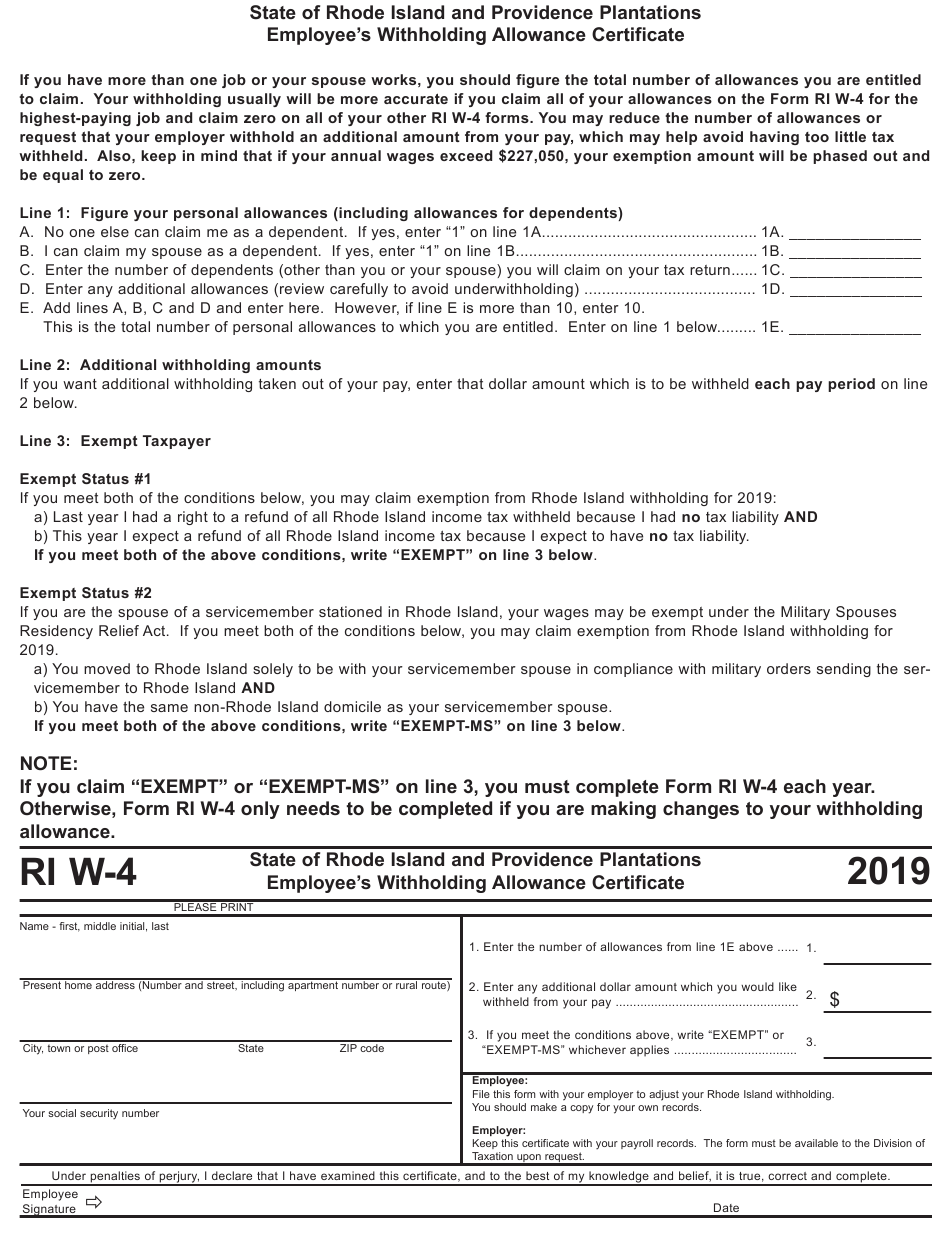

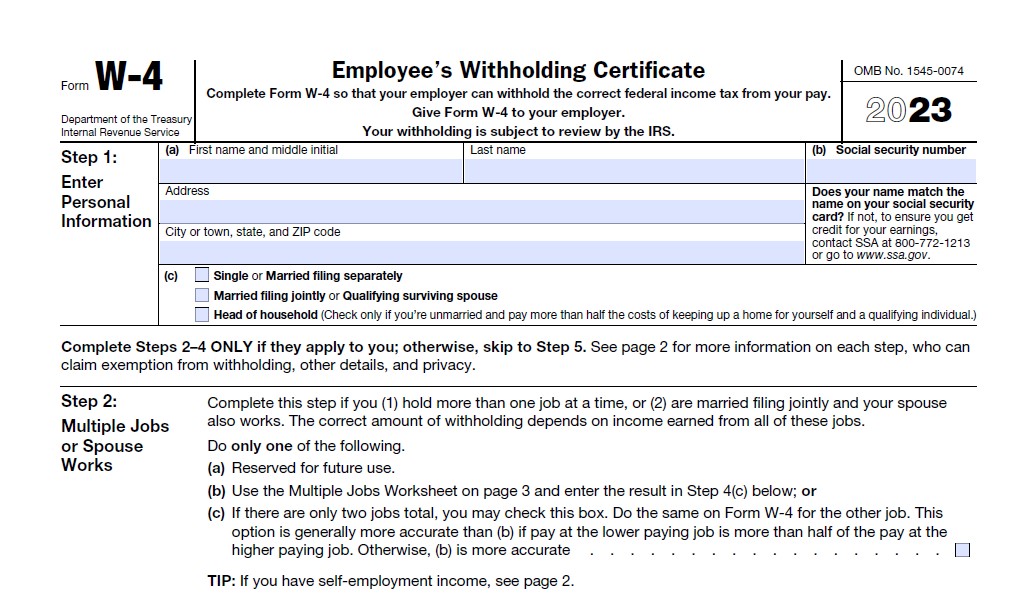

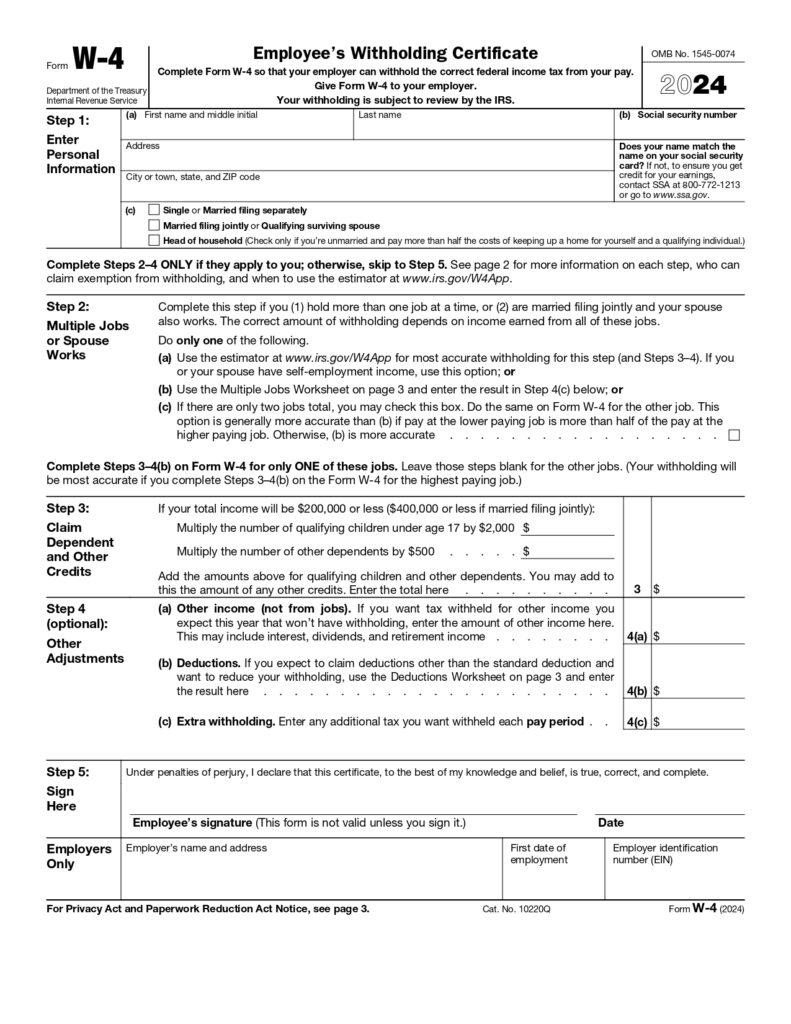

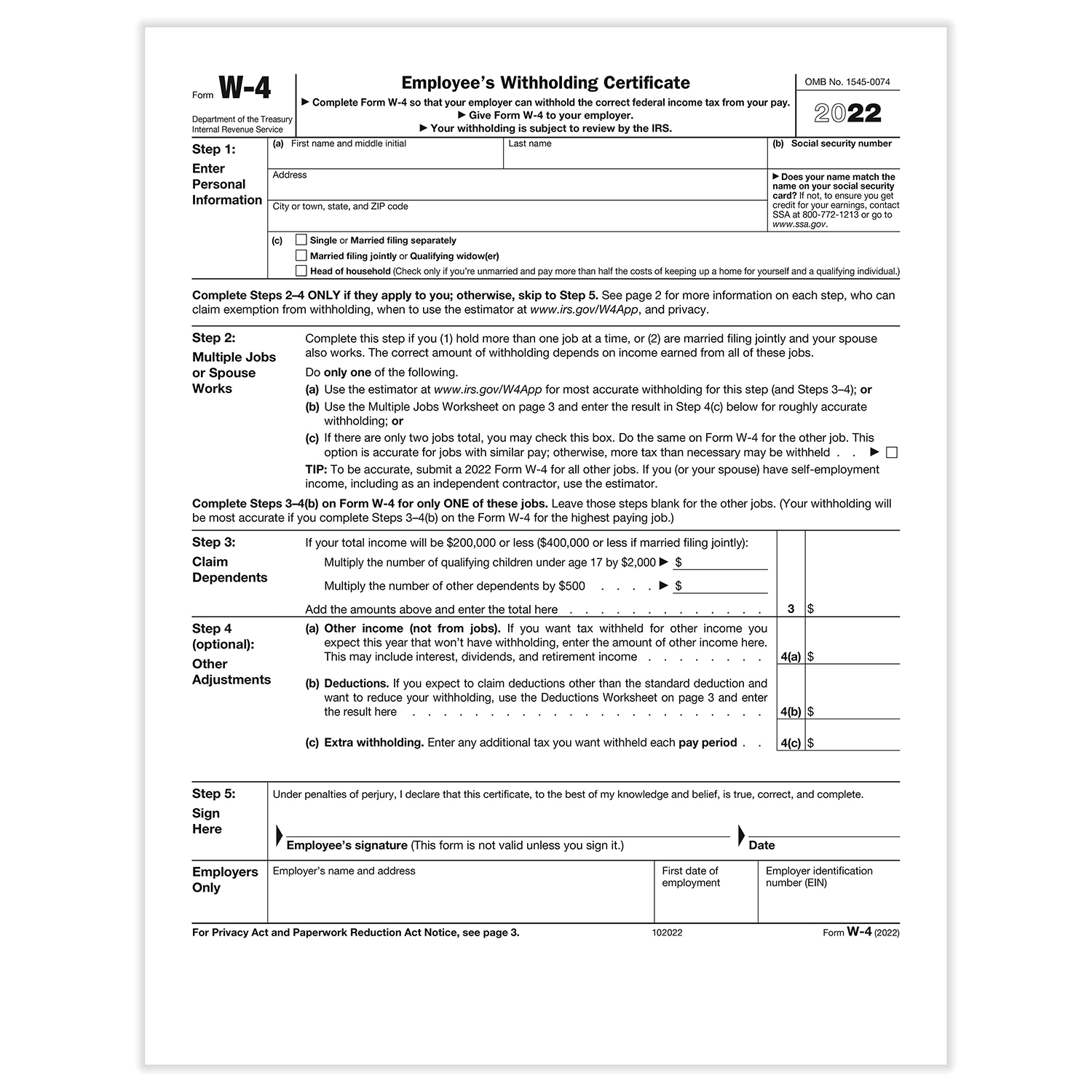

Printable W 9 Tax Form 2025 Printable Free Sue Lettie, Your employer or payer will use this form to determine the amount of your provincial tax deductions.

Form T2203 (9408C; SK428MJ) Part 4 2025 Fill Out, Sign Online and, Find all the canadian federal and provincial 2025 tax forms.

2025 Personal Tax Credits Return Form 2025 Kylen Deerdre, This form helps your employer or payer determine the amount of provincial tax deductions.

W9 2025 Printable Form Milka Suzanna, Turbotax's free saskatchewan income tax calculator.

Tax Forms 2025 Schedule B at Winston Odell blog, Enter the amount from line 64 of schedule 1 (attach schedule 1, even if the result is 0) 420

Rental Agreement Saskatchewan Complete with ease airSlate SignNow, Saskatchewan 2025 and 2025 tax rates & tax brackets.

2025 Tax Forms 2025 Lindi Perrine, Last name first name and initial(s) date of birth (yyyy/mm/dd)

2025 Schedule A Form 940 Debra Eugenie, Use your taxable income to calculate your federal tax on schedule 1 and your provincial or territorial tax on form 428.